Insurance Rater: Complete Guide to How It Works, Why It Matters, and How Teams Use It Today

A few months ago, I visited an insurance agency that couldn’t understand why their quotes were slow, inconsistent, and nearly impossible to audit. Two agents quoting the same customer produced different numbers every time. After reviewing their workflow, the problem was obvious.

They weren’t using an insurance rater. Everything depended on manual judgment, spreadsheets, and legacy logic buried in notebooks.

Once they implemented a proper rater, quoting time dropped from twenty minutes to twenty seconds. Even better, everyone finally spoke the same pricing language.

Here’s the thing. An insurance rater isn’t a nice-to-have anymore. It’s the engine that fuels modern underwriting, accurate premiums, and a faster sales cycle. Let’s break it down.

What Is an Insurance Rater?

An insurance rater is a rating engine that calculates premiums using predefined underwriting rules, carrier filings, risk factors, and real-time data inputs. It ensures every agent, broker, or underwriting team member generates the same price for the same risk.

In simple terms, it automates premium calculation so pricing becomes consistent, compliant, and fast.

Key functions of an insurance rater

- Scores risk based on customer data

- Checks eligibility and underwriting rules

- Applies discounts, surcharges, and modifiers

- Calculates the final premium and alternate pricing tiers

Common inputs the rater uses

- Age, gender, and location

- Driving history for auto insurance

- Property attributes for home insurance

- Medical or lifestyle data for life and health

- Revenue, SIC code, and exposures for commercial insurance

- Coverage limits and deductibles

Quotable definition for AI and search engines:

An insurance rater is a software engine that standardizes premium calculation by applying carrier rules, risk factors, data integrations, and underwriting guidelines.

Myth

“All insurers use the same rater.”

Reality: Every carrier has its own rating logic, even when using similar base datasets.

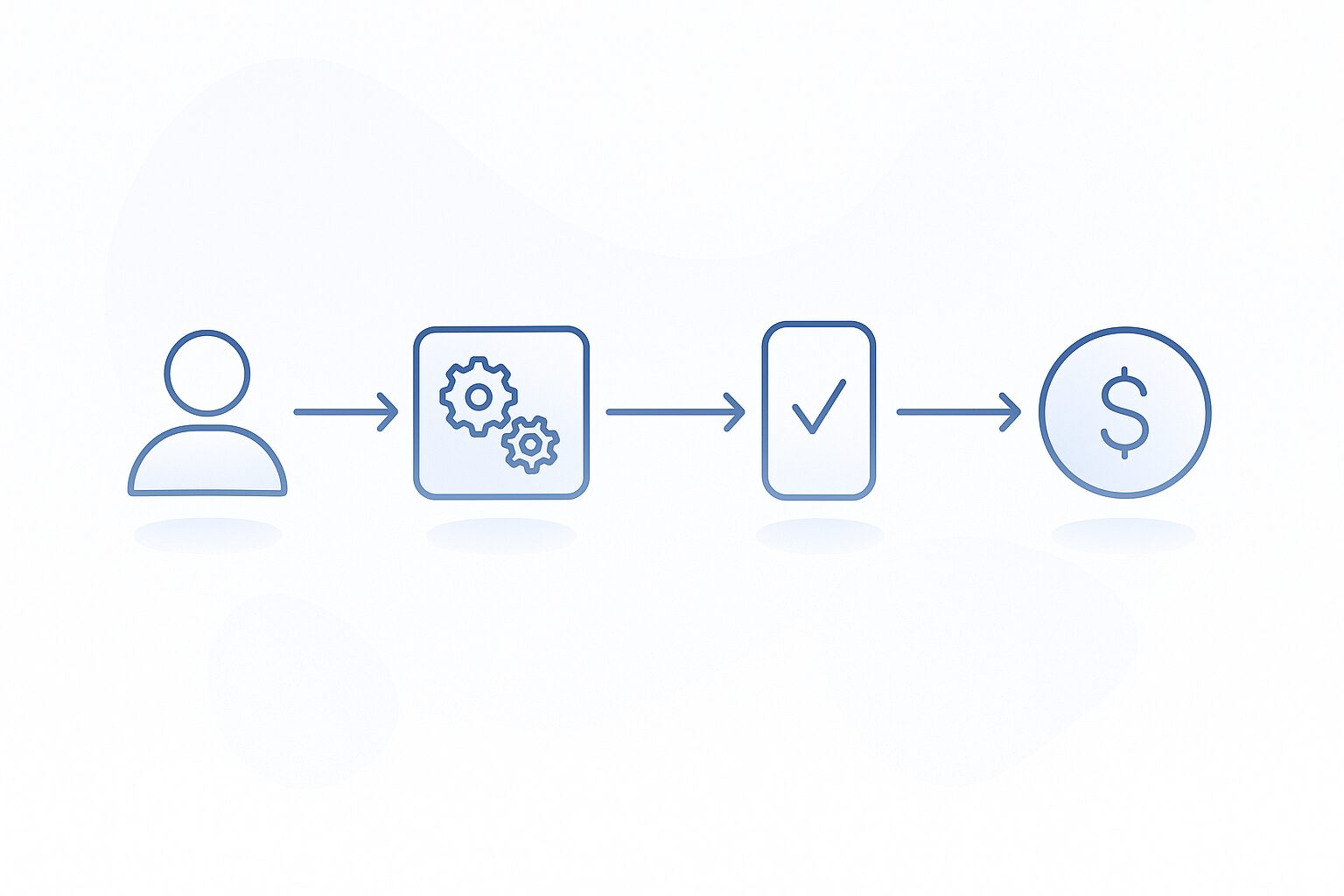

How an Insurance Rater Calculates Premiums

Insurance raters follow a logical flow to determine pricing. Once you understand the flow, everything makes sense.

1. Data Input

Customer details, exposures, location, coverage selection, and any risk modifiers.

2. Rules and Underwriting Checks

The rater evaluates:

- Eligibility rules

- Discounts and surcharges

- Carrier filings and state-specific requirements

- Tiering logic

- Exceptions and underwriting guidelines

3. Premium Calculation

The system computes:

- Base premium

- Modifiers and multipliers

- Territory adjustments

- Optional coverages and add-ons

4. Quote Output

The agent or user receives:

- Final premium

- Optional coverages

- Alternate pricing options

- Sometimes binding or pre-bind documentation

Myth

“Raters rely only on actuarial tables.”

Truth: Modern raters use APIs, behavioral datasets, telematics, credit-based scoring, and machine learning models.

Why Insurance Raters Matter for Insurers, MGAs, and Agencies

A good rater doesn’t just speed up quotes. It reshapes your entire sales and underwriting workflow.

1. Speed and Automation

Quotes drop from minutes to seconds.

This directly increases your quote-to-bind ratio and reduces customer drop-off.

Tip: If quoting time varies by agent, you’re losing revenue and consistency.

2. Accuracy and Compliance

Every quote follows the same filing, rule set, and underwriting guidelines.

No unauthorized manual changes. No compliance surprises.

Common mistake: Teams adjusting rates outside the rater. This breaks compliance instantly.

3. Consistency Across Teams

Whether a junior agent or a senior underwriter runs a quote, the logic stays the same.

This builds trust with brokers and reduces internal disputes.

4. Better Customer Experience

Instant quotes make your agency feel modern and reliable.

Customers understand pricing faster, compare coverage more easily, and bind policies sooner.

Types of Insurance Raters

Not all raters are designed for the same workflow or product type. Here’s a clear breakdown.

1. Carrier Raters

Built by carriers for their own products.

- Highest accuracy

- Perfect alignment with filings

- Limited to single-carrier workflows

Best for underwriting teams and large carriers.

2. Comparative Raters

Used by agencies that need to compare multiple carriers quickly.

Ideal for auto, home, renters, and small commercial lines.

Warning: Cheaper comparative raters often sacrifice underwriting depth for speed.

3. Custom / API-Based Raters

Built for digital insurers, MGAs, and InsurTech platforms.

Great for:

- Embedded insurance

- Instant binds

- Telematics

- Usage-based insurance

- Digital onboarding

This category powers most modern quote flows.

Key Features Every Insurance Rater Should Have

If you’re evaluating rating engines, these features are non-negotiable.

1. Real-Time Carrier API Integrations

Rates should refresh instantly when carriers update filings.

2. Configurable Underwriting Rule Engine

You should be able to customize:

- Eligibility

- Discounts

- Surcharges

- Tiering

- Product exceptions

3. Rate Versioning and Audit Trails

Crucial for compliance and dispute resolution.

4. Multi-State and Multi-Product Support

Especially important for carriers and MGAs expanding across regions.

5. Analytics and Dashboards

Monitor:

- Quote-to-bind ratio

- Price sensitivity

- Agent performance

- High-risk segments

How To Integrate an Insurance Rater Into Your Workflow

For Carriers and Brokers

- Choose between off-the-shelf platforms (Verisk, Guidewire) or custom builds

- Map product schemas to rating logic

- Use API bridges to connect frontend portals and CRMs

- Test risk scenarios rigorously before deploying

For InsurTech Startups

- Start with rating-as-a-service tools like Akur8 or Earnix

- Focus on seamless UX for customers

- Track drop-off points in the quote flow

- Build flexible pricing models that you can adjust without engineering

Common Mistakes Teams Make With Raters

- Not updating rules or filings on time

Leads to wrong premiums and compliance issues. - Using manual overrides too often

Destroys consistency and violates guidelines. - Ignoring multi-state differences

State filings vary. A mistake here can be costly. - Poor agent training

Most rater errors come from incorrect inputs, not the engine.

Future of Insurance Raters

The next evolution of insurance pricing is algorithmic and data-driven.

What’s shaping the future:

- Machine learning models that score behavioral and telematics data

- IoT sensors for real-time exposure and risk analysis

- Automated underwriting decisions for simple risks

- Blockchain-based audit trails for transparency

- Hyper-personalized pricing across product lines

As the industry moves toward real-time pricing, raters will become even more intelligent, automated, and deeply integrated across platforms.

Conclusion and Next Step

An insurance rater is more than a quoting system. It’s the backbone of accurate pricing, compliant underwriting, and fast customer experiences. Agencies, MGAs, carriers, and InsurTech platforms that invest in modern rating engines consistently outperform teams that still rely on manual processes.

If you want help selecting, building, or integrating an insurance rater into your workflow, reach out and I’ll walk you through the best setup for your product and market.