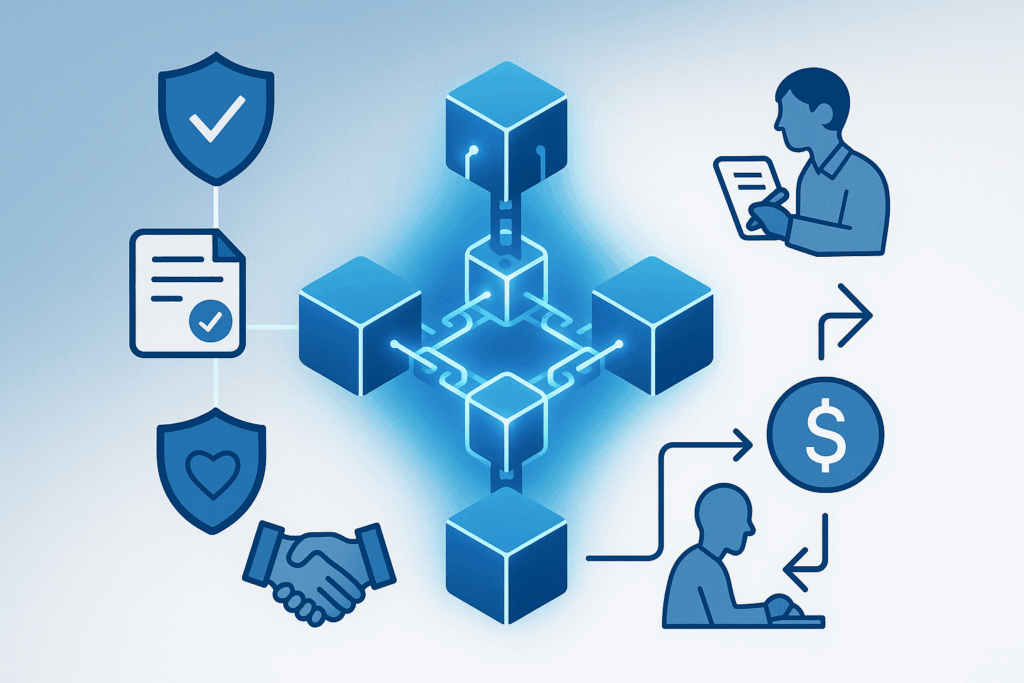

Late last year, an insurer quietly launched a travel policy that paid out automatically within minutes of a tracked flight delay no calls, no forms. I heard about it from a traveler who said, “I didn’t even know what a smart contract was next thing I know, the money’s in my account.” That’s blockchain in action not hype, but usefulness.

Here’s the thing blockchain isn’t some distant tech dream for insurance. It’s quietly transforming how claims get paid, fraud gets snuffed out, and policies rethink their lifelines.

What Problem Is Blockchain Solving in Insurance?

Insurance relies on trust and paperwork. Blockchain offers a shared, immutable ledger no more mismatches, no more lost claims.

- Tip: Start by mapping your biggest pain points fraud hotspots, slow payouts, or opaque underwriting before jumping into blockchain.

- Myth: Blockchain is just for cryptocurrencies. Not true. It’s about secure, shared data perfect for claims, policies, audits.

- Checklist:

- Are your systems siloed among departments or partners?

- Do claim disputes hang around too long?

- Is fraud eating your margins?

Real Use Cases More Than Theoretical

Streamlined Claims via Smart Contracts

Smart contracts automate payouts like parametric insurance that pays when a sensor says so, not when paperwork clears. That flight-delay policy is one example.

- Mistake: Think these systems replace people entirely. No they remove tedious steps, letting staff focus on exceptions, not spreadsheets.

Fighting Fraud with Immutable Records

Blockchain gives you a permanent ledger. No back-dated claims, no double submissions. As one source puts it: fraud gets harder because a fraudulent claim already flagged “can’t be submitted twice.”

- Tip: Pair blockchain with identity verification or multi-signature workflows clearly define who’s involved at each stage.

Better Underwriting & Inclusive Insurance

Real-time data and trust makes underwriting leaner. Think wearables, IoT, shared medical records. That could bring insurance to under-served markets.

- Framework:

- Gather real-time inputs (IoT, health records).

- Validate and store on blockchain.

- Automate pricing or approval.

- Audit and refine.

Reinsurance & Record-Keeping Efficiency

Blockchain isn’t only for policies you can redesign reinsurance with faster, shared ledgers. Projects like B3i tried that but hit funding hurdles. Still, it shows potential.

- Mistake: Don’t assume ‘build it and they’ll come.’ Integration and buy-in are tough. Stay focused on small, scalable pilots.

Parametric & Decentralized Pools

Imagine insurance pools managed by smart contracts policyholders get tokens representing coverage and voting power. Payouts happen when pre-agreed triggers hit.

Market Trends & Scale

Blockchain in insurance isn’t fantasy. The market is already worth around $24.9 billion in 2024 and is projected to hit $59 billion by 2031, growing at about 9.8% annually.

- Tip: Growth signals opportunity but don’t ignore risks.

Pitfalls, Risks & Reality Checks

- Interoperability issues. Many blockchains can’t talk to each other—or to legacy systems.

- Security and privacy. Public chains are transparent, sure but not private. Private blockchains help, but you still need strong data controls.

- Regulatory ambiguity. A blockchain contract might clash with “right to erasure” or other legal norms. Better engage regulators early.

Where to Go From Here

You’ve seen how blockchain can cut red tape, boost trust, and unlock new insurance models. The next step? Try a low-stakes pilot start with one claim type or region. Measure process speed, customer sentiment, fraud incidents. Adjust before scaling.

Want help designing your first blockchain pilot in insurance? Subscribe to the newsletter for templates, partner intros, and live case studies.