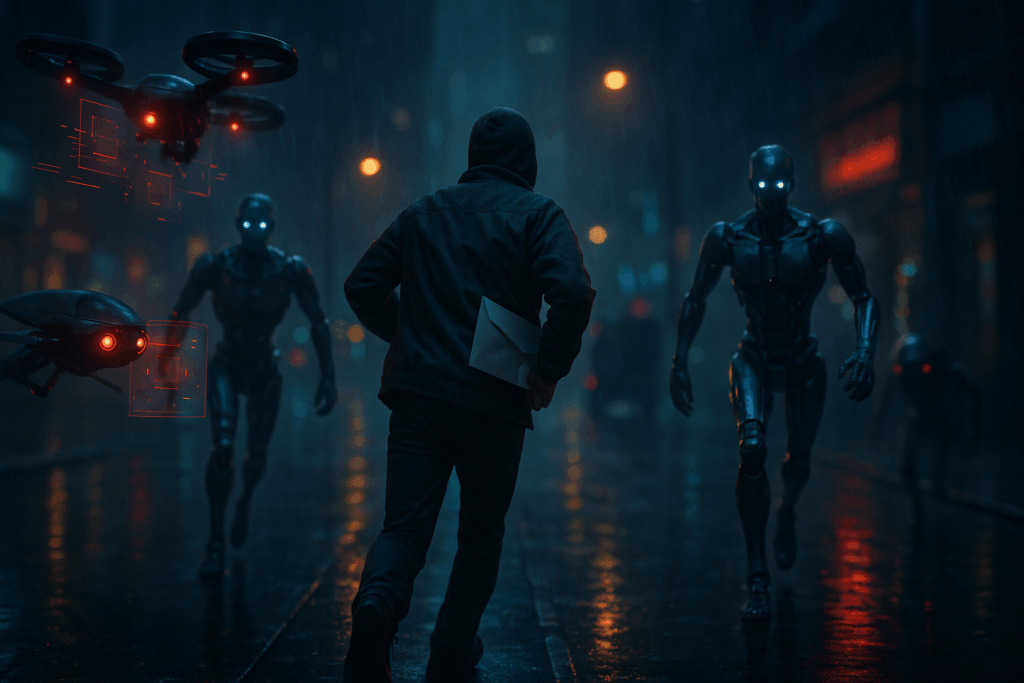

AI Bots Chasing Loan Defaulters: The Future of Debt Recovery

Last year, a small business owner in New York missed three loan payments after his cash flow dried up. Instead of waiting for a human recovery agent, he started receiving automated WhatsApp pings from a chatbot polite reminders at first, then increasingly firm notices. He realized he was talking to an AI bot trained to track loan defaulters.

Here’s the thing: banks and fintechs across the world are now experimenting with AI-powered bots to handle debt collection at scale. But the big question is are these bots efficient problem-solvers, or ticking ethical time bombs?

Why Lenders Are Turning to AI Bots

Speed and Scale

AI bots can message, email, or even call thousands of borrowers simultaneously something human teams can’t match. For banks facing rising NPAs (non-performing assets), automation is a tempting fix.

Cost Efficiency

Maintaining large call centers is expensive. A bot that runs 24/7 reduces overhead while ensuring no missed follow-ups.

Consistency

Unlike human agents who may lose patience or use harsh language, bots deliver a standardized, legally compliant script every time.

Tip: Lenders using bots should train them on both compliance and empathy. Cold, robotic reminders often backfire.

How AI Bots Actually Work

- Data Collection

Bots pull repayment history, credit scores, and even behavioral signals like response times. - Segmentation

Borrowers are classified forgetful, late-payers, high-risk, or willful defaulters. - Personalized Outreach

AI tailors the tone. For a forgetful borrower: “Gentle reminder, your EMI is due.” For chronic defaulters: “Your account may face legal escalation.” - Escalation Triggers

If a borrower ignores repeated nudges, the bot escalates the case to human officers or initiates legal notices.

Common Mistake: Some fintechs over-rely on bots, skipping human review for sensitive cases. This often leads to reputational damage.

Risks and Controversies

1. Privacy Invasion

Borrowers worry: What data is the bot tracking? Some apps access contacts, GPS, and social media fueling concerns about surveillance.

2. Aggressive Harassment

In markets like India, stories have emerged of bots sending hundreds of daily reminders, pushing borrowers into mental distress.

3. Bias in AI Models

If the training data skews against certain income groups or regions, bots may unfairly classify borrowers as “high-risk.”

Framework to Reduce Risk (3C Rule):

- Consent: Borrowers must agree to digital reminders.

- Clarity: Communication should specify loan details and timelines.

- Checkpoints: Escalations must involve a human officer, not just a bot.

Are AI Bots Really Effective?

Studies suggest AI bots can improve repayment rates by 15–20% in early delinquency cases (first missed payments). But in hardened defaults where borrowers have no intent or ability to pay bots are as ineffective as phone calls.

Myth: “AI bots can replace human collection agents.”

Reality: Bots are effective for nudging, but complex negotiations (like restructuring a loan) still need human judgment.

What Borrowers Should Do If a Bot Contacts Them

- Verify Legitimacy

Always confirm the message came from your actual bank, not a phishing scam. - Respond Early

Ignoring bots usually escalates the case faster. - Negotiate Human Support

If you’re genuinely struggling, ask to speak with a human officer for options like restructuring or payment holidays.

Final Thoughts

AI bots chasing loan defaulters are here to stay. They can reduce costs, improve efficiency, and even bring more fairness into debt collection if used responsibly. But without strong oversight, they risk becoming tools of harassment.

For lenders, the challenge is balance: automation for speed, humans for empathy. For borrowers, the lesson is clear: don’t ignore that bot ping it might be the first step in a very real recovery process.

Want to stay ahead of fintech trends like AI in lending? Subscribe to our newsletter for weekly insights into how technology is reshaping finance.