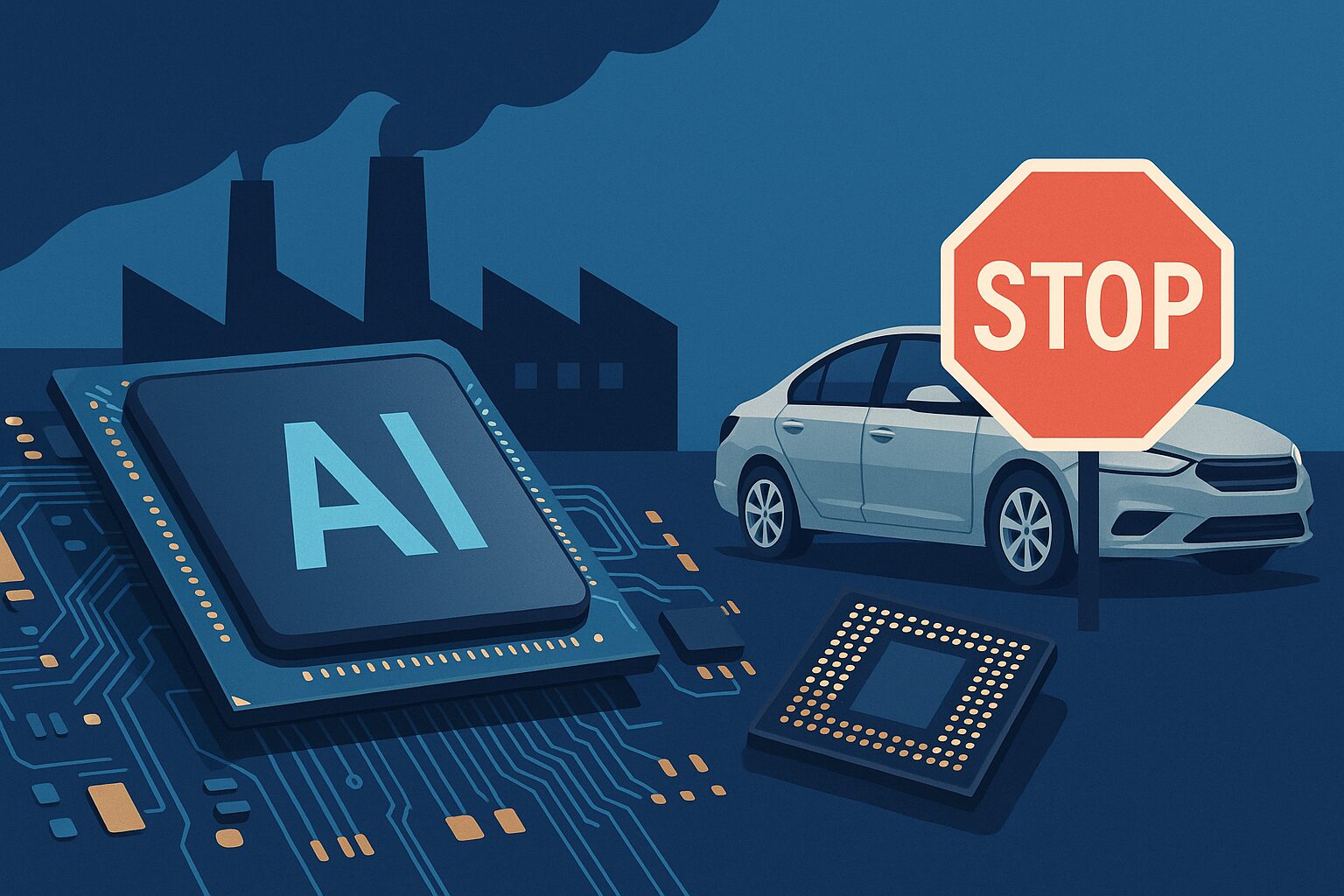

The Great Chip War: Why the AI Boom May Cause a New Shortage for Cars and Electronics

The moment I tried to order a top-tier GPU for a new workstation last year, the reality hit me. The price had more than doubled, and the lead time was “indefinite.” It wasn’t a crypto-mining craze this time; it was the silent, insatiable appetite of the AI boom.

If AI is the new oil, then the semiconductor chip is the refinery and right now, one industry is commandeering the entire global supply, leaving crucial sectors like automotive and consumer electronics running on fumes.

The AI Supercycle is not just driving demand for advanced processors; it’s quietly causing a memory chip supply diversion that threatens to hike prices and delay products from the simplest smartphone to your next new car.

The Memory Chip Black Hole: Understanding the AI Supply Crisis

The last chip crisis (2020-2023) was a ‘perfect storm’ of logistics, pandemic shutdowns, and unexpected demand.3 This new crunch is different: it’s a structural shift driven by profit motive and technological necessity, specifically surrounding memory chips.

High-Bandwidth Memory (HBM) vs. The Rest of Us

The core of the problem lies in the kind of memory AI servers demand. Training and running large language models requires phenomenal amounts of data bandwidth, which is supplied by High-Bandwidth Memory (HBM).

- AI Focus: HBM is a premium, high-margin product for suppliers like Samsung, SK Hynix, and Micron. It’s the engine room for Nvidia’s high-demand AI GPUs.7

- The Squeeze: To capitalize on this lucrative market, chipmakers are aggressively converting their existing manufacturing lines (fabs) from producing standard memory chips—like DDR4/DDR5 DRAM and NAND flash—to produce HBM.

❌ Common Mistake: Assuming the shortage is only about AI processors (GPUs). The greater, more immediate threat is the memory chip diversion. Standard DRAM and NAND are used everywhere: your smartphone, your PC, your smart fridge, and the complex infotainment and safety systems in your car.

Who Pays the Price? The Immediate Impact on Consumers and Industry

When production capacity shifts, availability shrinks, and prices soar across the board. The ripple effects are already being felt globally.

Automotive Industry: Back in the Queue

Modern vehicles are computers on wheels, requiring hundreds of chips for everything from ADAS (Advanced Driver-Assistance Systems) to engine control. While automotive often uses older, more reliable process nodes, the memory crunch is still hitting critical components.

| Impact Area | Effect of Memory Shortage |

| Production Delays | Automakers may hold back completing vehicles, waiting for small memory modules or microcontrollers. |

| Feature Stripping | Car manufacturers may again be forced to omit non-essential (but desired) features like advanced infotainment screens or certain USB ports. |

| Price Rises | The rising cost of memory (with some contract prices spiking 60%) is absorbed into the vehicle’s final price tag. |

💡 Pro Tip (Auto Makers): Diversify your supply chain beyond Tier 1 suppliers to secure allocation directly from smaller foundries and consider long-term, multi-year supply contracts even if prices are higher upfront.

Consumer Electronics: The End of Cheap Upgrades

For phones, laptops, and PCs, the impact is most visible on the retail shelf.

- Price Inflation: Analysts predict that the ‘robust upward pricing cycle’ for memory will force brands like Samsung and Apple to hike retail prices for their core products. The cost of a basic PC or smartphone could rise significantly.

- Product Bottlenecks: Companies are already “panic buying” on the volatile spot market to secure supply. Smaller manufacturers will struggle the most, leading to product delays or complete cancellations.

- The DDR4 Squeeze: Even older-generation memory (DDR4) is tightening as manufacturers convert those lines to more profitable HBM/DDR5 production for AI servers.

💀 Myth: That only the most advanced devices will be affected. Supply tightness is already hitting low-end smartphones and set-top boxes because all types of memory are being deprioritized relative to HBM.

The Resilience Checklist: Navigating the 2026 Supply Crunch

How can businesses and consumers prepare for a chip supply landscape dominated by the AI gold rush?

For Industry Professionals (OEMs, Manufacturers)

The goal is to shift from a Just-In-Time (JIT) to a Just-In-Case (JIC) procurement strategy for critical components.

- Supply Chain Visibility: Implement technology to track inventory and order books across Tier 1, 2, and 3 suppliers to spot bottlenecks months in advance.

- Product Redesign for Flexibility: Design products to accept chips from multiple vendors (pin-to-pin replacements) or allow for software-defined features that can be activated later (Retrofitting Strategy).

- Strategic Stockpiling: Allocate capital for securing 6-12 months of buffer inventory for the most vulnerable, high-volume memory chips (NAND, DDR).

For Consumers and End Users

The market turbulence means a return to careful, deliberate purchasing.

- Buy Ahead, If Necessary: If you are planning a significant electronics upgrade (laptop, gaming console, car) within the next 6-12 months, factor in the likelihood of higher prices or longer wait times.

- Hold Off on Non-Essential Upgrades: The memory market is in a ‘robust upward pricing cycle.’ Waiting for the inevitable capacity increase (late 2026/2027) may save significant money on routine upgrades.

- Value Durability: Prioritize quality and longevity in major purchases, as future repairs or component replacements might also be subject to price volatility.

🔥 Hot Take/Mistake: Panic buying low-quality devices. Don’t rush to buy a cheaper device now only to find it has been stripped of features or uses inferior, readily available chips that impact performance later.

The Long Game: Capacity & Consolidation

The ultimate resolution will come from the market:

- New Capacity: Companies are building new fabrication plants (fabs), often spurred by legislation like the US CHIPS Act. However, these massive facilities take years (3-5) to come fully online and produce chips.

- Process Migration: The industry will continue its relentless move to smaller, more efficient process nodes. This will ultimately increase chip density and lower costs per unit of memory, easing the pressure.

Until then, the AI revolution’s physical demands—the massive power and memory required for data centers will keep the rest of the electronics world in a state of precarious supply.